Wind Power Dollars and Sense

Government agencies and the wind industry have successfully portrayed wind-generated electricity as “green” and as a price-competitive, potentially significant alternative source of power which could reduce dependence on ‘dirty’ fuels.

While wind generated electricity may make sense in some circumstances, industry and government claims for its widespread use are not currently supported by sound science or economic analysis of costs v. benefits.

“There is a principle which is a bar against all information, which is proof against all arguments and which cannot fail to keep a man in everlasting ignorance — that principle is contempt prior to investigation.” — Herbert Spencer

Untold millions of tons of gold are in the waters of the earth’s oceans. Why aren’t we taking this gold from the seas?

It is the dilution that stops us. If we can not obtain at least eight dollars worth of gold from a ton of water, we will go broke from the costs of extraction.

Despite the multi-billion dollar expenditure of taxpayer funds by government and the “renewable energy” industry during the past 35+ years, the results have proven disastrous in economic terms. The Department of Energy (DOE) and other federal and state agencies have spent over $40 billion on “energy research and development” and subsidies, not including private R&D costs, yet virtually nothing has been ‘developed’ that is technologically, economically or environmentally sound.

The subsidy of “green” energy, such as solar, geo-thermal, hydro, bio-mass and wind, has distorted the operation of electrical power markets, increased electricity rates to consumers, increased taxes at all levels of government, diverted resources from industry financed (private) research for more efficient and cleaner means of producing and distributing power, politicized energy production, and prevented or delayed bringing more base capacity on line to reliably meet present and projected increases in demand.

The current national debate on construction of “wind farms” is, to a large extent, focused on environmental and ‘scenic’ issues, and the effects on local property values. Depending on location and other factors, these questions may have merit; however, they are often a distraction from other important questions, and are too often confused by political agenda, and opinions or bias of opponents and proponents alike—which may have little to do with logic, sound science or economics. Because of their subjective, emotional or often controversial nature, these questions are not addressed here except as they relate to laws of economics and engineering.

The basic economic factors and taxation-subsidy policies affecting wind generation are well known and have been recognized in the United States and worldwide by opponents and proponents alike. There is little disagreement on basic economic realities. There is disagreement on the wisdom of government-mandated social engineering and economic intervention for which taxpayers and ratepayers are being forced to bear the substantial cost of waste, mismanagement and even corruption.

Public discussion of these issues is often limited because it is not considered ‘pertinent’ to politicized energy policy. Industry and elected officials always seem to have a ‘new plan’ to correct past ‘mistakes.’

The average taxpayer’s/electric ratepayer’s ignorance of and confusion about wind power are largely due to official bias and the lack of factual information. So-called ‘facts’ are rarely examined critically in the news media, nor does the general media “follow the money” to determine who gains and who loses.

The purpose of this report is to examine some of the ‘dollars and sense’ issues related to industrial-scale wind-generated electricity in order that the costs v. the benefits can be rationally weighed.

Government intervention

Since the late 1960’s, the American public has been continuously subjected to predictions of impending environmental catastrophe resulting from modern industrial technology and processes. Radiation, air and water pollution, depletion of natural resources, deforestation, acid rain, global warming, overpopulation, extinction of endangered species, and ozone depletion are but a few of the highly publicized ‘threats’ to life on earth.

With each passing week, some new ‘danger’ emerges, usually based on faulty science and blown out of proportion by politically-motivated ‘environmental’ organizations and media pandering. Public fears are heightened and elected officials are pressured to “do something.” Doing “something” usually means spending huge amounts of taxpayer’s funds and enacting numerous new “laws” and a maze of complex regulations, almost without exception to the detriment of the average citizen.

All too often, logic, fact, and sound scientific and economic analysis are ignored. They don’t make good headlines or improve a politician’s chances for reelection. Fear does. Optimism and faith in man’s intelligence and ingenuity—to overcome technical problems in the quest to improve our standard of living—take a back seat to government intervention. “Political solutions” result in paralysis, or worse.

In times of “crisis”, real or fabricated, the general public has been conditioned to accept the idea “someone has got to do something.” That “someone” is, of course, government. Instead of doing “something” themselves, John and Jane Public expect and demand “government” must find a solution to the “problem.” And government officials, along with their “corporate partners”, are only too happy to oblige. They are here to “help us” as long as John and Jane Public consent to be taxed, regulated and manipulated—and remain relatively content in a state of mental stupor and physical dependency while being fleeced.

Is there Constitutional authority for federal tax credits, subsidies, research grants and similar expenditures of public funds for wind power, or for any other type of electrical generation?

The significance of this question is directly related to the economic, social and moral consequences of decades of federal “energy policy”, yet it is brushed aside as being irrelevant by most elected officials, and seems to be of little concern to most Americans despite the fact they give lip service to free markets, individual responsibility and Constitutional government.

The key to American economic, cultural and industrial achievement and productivity has been the organic Constitutional limitations on the power of government to interfere with private, productive, and peaceful human endeavors and with the marketplace. According to James R. Glassman of the American Enterprise Institute, “Abundant, low-cost energy is the key to prosperity, and prosperity is the key to cleaner air and water, as numerous studies, including a survey of 117 countries by the World Bank and the World Economic Forum, have shown.”

Government produces nothing. It can only redistribute wealth created by private initiative, or destroy it. When Constitutional prohibitions on federal authority are ignored or rejected, the rights and market choices of individuals are limited and become hostage to the ambitions of powerful, politically-connected special-interests who are the beneficiaries of government’s wealth redistribution schemes—exactly what has happened in the field of “alternative energy.”

Politicians and ‘renewable energy’ special-interests have in fact socialized the costs of this “boutique” form of electricity production. By legislating that all taxpayers and ratepayers must shoulder the largely hidden expenses of enriching a few corporations and individuals, politicians are able to buy the votes of uninformed citizens, claiming they are “doing something to preserve the environment, provide jobs and reduce our dependence on ‘dirty’ fuels.”

The clear answer to the question posed is: there is no more Constitutional authority for subsidizing wind farms than there is for peanut farms, Christmas tree farms or corn (ethanol) farms.

There may be limited Constitutional authority for regulatory oversight of interstate and international commerce pertaining to generation and distribution of power, and for enforcing contracts. There may be some limited authority to establish certain technical standards to protect citizen’s safety and property.

But as long as Americans ignore Constitutional prohibitions against federal funding for energy production, and allow political and bureaucratic tampering in the marketplace, we will continue to suffer from shortages, price distortions, and power disruptions, and continue to pay a premium for electric power; and the Kenneth Lays and the Enrons, locally and nationally, will continue to work their magic on taxpayers and ratepayers.

The ‘infant’ industry

Windpower has been portrayed as the scrappy ‘underdog’ of the energy industry, facing the powerful interests of “Big Oil” and “King Coal” who are out to crush the “green” threat to their energy empires. The truth is nearly the opposite. Many of America’s largest corporate conglomerates have, for decades, been the prime movers and shakers in ‘renewable’ energy, and they have used their political and financial muscle to gain favorable tax and marketing treatment.

Beginning in the mid 1970s, Mobil, ARCO, Shell, Exxon, Amoco, BP, and Enron were just a few of the heavy-hitters engaged in projects for ‘renewable’ energy Research and Development.

Their actions were, and are, seen by some advocates of ‘renewables’ as indicative of the potential for ‘renewables’ competitiveness. But total private-sector investment in 1995, for example, was less than 1 percent of total investment world-wide in all forms of energy.

Proponents have constantly argued for the need for continued subsidies for wind using the rationalization that ‘commercialization is just around the corner.’ For instance, in 1985 the American Wind Energy Association testified before Congress, “the goal for this industry, the achievable goal…is the lowest-cost source of electricity…available to a utility by 1990.” 3 Yet the subsidies continue and wind power advocates continue to demand they be expanded.

What motivated multinational oil and gas conglomerates to become involved in ‘renewables’ when U.S. generation from these “renewable” sources is only about 2 percent of the total market?

“To a large degree, it reflects the company’s deep involvement in a ‘sustainable development’ and ‘corporate social responsibility’ movement that’s all the rage among ideological environmentalists, UN and European Union bureaucrats, and corporations that hope to reap big bucks from new regulations governing the use of energy, resources and just about everything else.” 4

Wind power is not cheap…

Wind power, along with other sources of “renewable energy”, has been portrayed as a “cheap, inexhaustible and benign” source of electricity compared with ‘fossil fuels’ or nuclear energy. Some proponents have even claimed it is “free” energy.

Producing electrical power involves the conversion of other forms of energy into electricity. Whether it is wind, coal, solar or nuclear, there is no such thing as free, clean or safe electric energy production. Every form of conversion and distribution has economic, environmental and human safety costs. With some forms of conversion, costs outweigh the benefits.

Some costs are apparent and are paid directly by the consumer in the monthly electric bill. There are also ‘hidden’ costs, such as government subsidies and tax credits which are spread out and paid by all taxpayers. And there are additional ‘hidden’ costs which are imposed on power suppliers by government legislative and regulatory mandate which, in turn, are passed on to the electrical consumer as part of the monthly bill.

The average consumer is not aware of the economic and engineering complexities of electric power generation, transmission and distribution. He or she expects the lights to turn on at the flick of a switch and the refrigerator to keep the food cold while the family sleeps. The consumer sees power lines everywhere and believes all that is needed is a wire from the nearest pole to the house and bingo, ‘we’re in business.’ Only during a power failure, when a dark room fails to respond to the light switch, do we realize how important power is in our daily life. Like the air we breathe, we don’t really think about it until it is missing.

Problems with the grid

‘Renewable’ energy, particularly wind power, is a highly problematic, ill-understood and expensive technology. The popularly held idea that government can mandate “green” energy and that wind generators can just be ‘hooked up’ to the grid, thus providing reliable, inexpensive, extra capacity to meet demand, or as a substitute for other fuels, is a foolish notion, as simplistic as it is false.

The vast system of electricity generation, transmission, and distribution covering the United States and Canada is essentially the world’s largest “single machine”. The “grid” system makes it possible for utilities to engage in wholesale electric power trade, allowing utilities to reduce power costs, increase power supply options, and improve reliability.

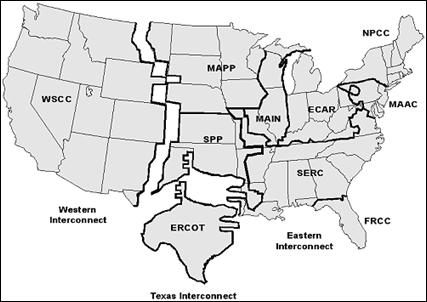

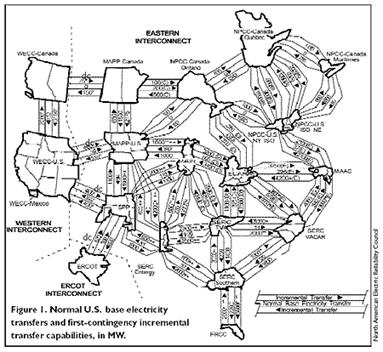

The system has evolved into three major power grids which also include smaller power pools. They are the Eastern Interconnected System, consisting of the eastern two-thirds of the United States; the Western Interconnected System, consisting primarily of the Southwest and areas west of the Rocky Mountains; and the Texas Interconnected System consisting mainly of Texas. The interconnected utilities within each power grid coordinate operations and buy and sell power among themselves.

Due to its physical characteristics, electricity follows the path of least resistance, thus the flow of electricity within the electric power system must be closely monitored and regulated (electrically) to ensure sufficient generating is available to meet demand.

Demand for electricity fluctuates continuously, based on factors such as time of day, season, and the characteristics of the territory served by the system. Overall reliability planning and coordination of the interconnected power systems are the responsibility of the National Electric Reliability Council (NERC), voluntarily formed in 1968 by the electric utility industry as a result of the 1965 power failure in the Northeast. NERC’s ten regional councils cover the 48 contiguous States and portions of Canada and Mexico. The councils are responsible for overall coordination of power policies affecting reliability and adequacy of service in their areas. They also exchange operating and planning information among their member utilities.

In the past, wholesale trade has been dominated by utility purchases from other utilities. Wholesale power sales by non-utilities to utilities and ‘wheeling’ (the transmission of power from one point to another) by utilities have both grown vigorously since the mid-1980’s. Whether this growth will be sustained is uncertain. The rate of growth slowed considerably between 1990 and 1995. Historically, almost all wholesale trade was within NERC regions. However, utilities are expanding wholesale trade beyond those traditional boundaries, and wholesale trade between NERC regions is also growing.

Prior to “deregulation”, which began in the 1990s, regional and local electric utilities were regulated, vertical monopolies. A single company controlled generation, transmission, and distribution in a given area. Each utility generally maintained sufficient capacity to meet its customer demand, and long-distance energy shipments were usually reserved for emergencies, such as unexpected outages. In essence, the long-range connections served as insurance against sudden loss of power.

The limited use of long-distance connections aided system reliability, because the physical complexities of power transmission increase rapidly as distance and the complexity of interconnections grow. Power in an electric network does not travel along a set path. When utility A agrees to send electricity to utility B, A increases the amount of power generated while B decreases production or has an increased demand. The power then flows from the “source” to the “sink” along all the paths that can connect them. This means changes in generation and transmission at any point in the system will change loads on generators and transmission lines at every other point—often in ways not anticipated or easily controlled.

To avoid system failures, the amount of power flowing over each transmission line must remain below the line’s capacity. Exceeding capacity generates excessive heat, which can cause the line to sag or break, or can create power-supply instability such as phase and voltage fluctuations. Capacity limits vary, depending on the length of the line and the transmission voltage. Longer lines have less capacity than shorter ones.

In addition, for an AC power grid to remain stable, the frequency and phase of all power generation units must remain synchronous within narrow limits. If a generator drops 2 Cycles below 60 Cycles, it will rapidly build up enough heat to destroy itself. Circuit breakers trip a generator out of the system when the frequency varies too much. But much smaller frequency changes can indicate instability in the grid. In the Eastern Interconnect, a 30-milli-Cycle drop in frequency reduces power delivered by 1 GW.

If certain parts of the grid are carrying electricity at near capacity, a small shift of power flows can trip circuit breakers, which sends larger flows onto neighboring lines to start a chain-reaction failure. This happened on Nov. 10, 1965, when an incorrectly set circuit breaker tripped and set off a blackout that blanketed nearly the same area as the one in August of that year.

After the 1965 blackouts, the industry set up regional reliability councils, coordinated by the North American Electric Reliability Council, to set standards to improve planning and cooperation among the utilities. A single-contingency-loss standard was established to keep the system functioning if a single unit, such as a generator or transition line, went out. Utilities built up spare generation and transmission capacity to maintain a safety margin.

In 1992, the economic rules governing the grid began to change with passage of the Energy Policy Act. This act empowered the Federal Energy Regulatory Commission (FERC) to separate electric power generation from transmission and distribution. Power “deregulation”—in reality, a change in regulations—went slowly at first. Not until 1998 were utilities, beginning in California, compelled to sell off their generating capacity to independent power producers, such as Enron and Dynergy.

The new regulations envisioned trading electricity like a commodity. Generating companies would sell their power for the best price they could get, and utilities would buy at the lowest price possible. For this concept to work, it was imperative to compel utilities that owned transmission lines to carry power from other companies’ generators in the same way as they carried their own, even if the power went to a third party. FERC (Order 888) mandated the ‘wheeling’ of electric power across utility lines in 1996. But that order remained in litigation until March 4, 2000, when the U.S. supreme Court validated it.

In the four years between its issuance and full implementation, engineers warned the new rules ignored the physics of the grid. The new policies “do not recognize the single-machine characteristics of the electric-power network,” Jack Casazza wrote in 1998. “The new rule balkanized control over the single machine. It is like having every player in an orchestra use their own tunes.”

“The fact is that this is an instantaneous system; it’s the only system in which you produce the product the absolute split second it’s needed. When you flip on a light switch a generator has to respond with the speed of light and provide this electricity. There is no time delay; you can’t route it. It goes in accordance to the law of science. Well, people don’t realize this.” 5

In the view of Casazza and many other experts, the key error in the new rules was to view electricity as a commodity rather than as an essential service. Commodities can be shipped from point A through line B to point C, but power shifts affect the entire singlemachine system. As a result, increased long distance trading of electric power would create dangerous levels of congestion on transmission lines where controllers did not expect them and could not deal with them.

Engineers warned problems would be compounded as independents added new generation at essentially random locations determined by low labor costs, lax local regulations, or tax incentives.

If generators were added far from the main consuming areas, the total quantity of power flows would rapidly increase, overloading transmission lines. “The system was never designed to handle long-distance wheeling,” notes Loren Toole, a transmission-system analyst at Los Alamos National Laboratory.

At the same time, data needed to predict and react to system stress—such as basic information on the quantity of energy flows—began disappearing, treated by utilities as competitive information and kept secret. “Starting in 1998, the utilities stopped reporting on blackout statistics as well,” says Ben Carreras of Oak Ridge National Laboratory, so system reliability could no longer be accurately assessed.

Finally, the separation into generation and transmission companies resulted in an inadequate amount of reactive power, which is current 90 degrees out of phase with the voltage. Reactive power is needed to maintain voltage, and longer-distance transmission increases the need for it. However, only generating companies can produce reactive power, and with the new rules, they do not benefit from it. In fact, reactive power production reduces the amount of deliverable power produced. So transmission companies, under the new rules, cannot require generating companies to produce enough reactive power to stabilize voltages and increase system stability.

The net result of the new rules was to more tightly couple the system physically and stress it closer to capacity and at the same time, make control more diffuse and less coordinated—a prescription, engineers warned, for blackouts.

In March 2000, the warnings began to come true. Within a month of the supreme Court decision, electricity trading skyrocketed, and so did stresses on the grid. The frequency stability of the grid rapidly deteriorated, with average hourly frequency deviations from 60 Cycle leaping from 1.3 mCycle in May 1999, to 4.9 mCycle in May 2000, to 7.6 mCycle by January 2001. The new trading had the predicted effect of overstressing and destabilizing the grid.

“Under the new system, the financial incentive was to run things up to the limit of capacity,” explained Carreras. In fact, energy companies did more: they ‘gamed’ the system. Federal investigations showed that employees of Enron and other energy traders “knowingly and intentionally” filed transmission schedules designed to block competitors’ access to the grid and to drive up prices by creating artificial shortages. In California, this behavior resulted in widespread blackouts, the doubling and tripling of retail rates, and eventual costs to ratepayers and taxpayers of more than $30 billion. In the more tightly regulated Eastern Interconnect, retail prices rose less dramatically.

After a pause following Enron’s collapse in 2001 and a fall in electricity demand (partly due to recession and partly to weather), energy trading resumed its frenzy in 2002 and 2003. Although power generation in 2003 increased only 3% above that in 2000, generation by independent power producers, a rough measure of wholesale trading, has doubled. System stress and frequency instability soared, and with it, warnings by FERC and other groups.

Major bank and investment institutions such as Morgan Stanley and Citigroup stepped into the place of fallen traders such as Enron and began buying up power plants. But as more players entered and trading margins narrowed, more trades are needed to pay off the huge debts incurred in buying and building generators. Revenues also shrunk, because after the California debacle, states refused to substantially increase the rates consumers pay. As their credit ratings and stock prices fell, utility companies cut personnel, training, maintenance, and research. Nationwide, 150,000 utility jobs evaporated. “We have a lot of utilities in deep financial trouble,” says Richard Bush, editor of Transmission and Distribution, a trade magazine.

Clearly, most of the troubling events described above resulted from politically-motivated, government meddling in the market place, including “tax incentives” to wind generators. 6

Eco-Energy Planning

The Eco-Energy Planning movement is based on the idea that energy markets are riddled with imperfections. Thus the policy of many state public utility commissions and the DOE has been to intervene in the markets with increased regulation and ‘incentives’ for renewable energy generation and for conservation. Major interventions are claimed to be necessary to “efficiently manage society’s energy choices.” Nobel Prize-winning economist Frederick Hayek called such intervention “the fatal conceit”: somehow, government planners have special knowledge that markets, investors, and industry lack.

Electricity and natural gas are taxed and controlled at every step. It’s important to remember all these taxes were imposed precisely for the purpose of punishing the market for producing and consuming energy. They cause, because they are intended to cause, a mismatch between supply and demand.

The government has always been shortsighted in its management of energy. In 1939, the Department of the Interior predicted we would run out of oil supplies in 1952. The State Department in 1947 said no reserves were left. Two years later, Interior weighed in again with a claim that reserves were running dry. State spoke up again in 1951 that the year to dread was 1964.

The government has been engaged in a sixty-year campaign to tell us to stop using energy, to stop consuming, to stop producing and transporting, and to otherwise become less dependent on private energy and more on the government. More recently, the government has begun telling us that we use the web too much and that this too must be unplugged, or else calamity is around the corner.

The only calamity that threatens us is the one imposed by the central planners who claim to have a better solution than the one the market economy provides. They never have, and they never will.

Professor David Simpson, in a recent paper published by The David Hume Institute, reaches the same conclusions about wind power in Great Britain. Simpson stated, “…the Government chose to ignore the lessons so painfully learned in the post-war era by governments and regulators all over the world. This is that governments and centralized planning processes are hopeless at adjudicating between technologies.”

“At the present time the cost of generating electricity from wind power is approximately twice that of the cheapest conventional alternative source. By 2010 the cost of subsidising wind and other renewable forms of energy is officially expected to be about £1 billion every year…adding about 2% to domestic electricity bills, and it is set to grow. Most consumers are unaware that they are paying this hidden levy, and they do not know what they are getting for it…It is widely believed that wind power will eventually become competitive in price with conventional sources of power. But projections by Government advisers, using relatively optimistic assumptions, show that even by the year 2020 a generation portfolio containing 20% wind power will still be more expensive than a conventionally fuelled alternative.

“No matter how large the amount of wind power capacity installed, the unpredictably variable nature of its output means that it can make no significant contribution to the security of energy supplies. A 20% share for Wind and other Renewables in power generation capacity will require a major re-engineering of electricity transmission and distribution networks, costing an extra £2.5 billion to £4.5 billion.

“In energy policy, as elsewhere, government decisions taken on the basis of short-term political pressures have unforeseen long term economic consequences, usually unfavourable. Wind power may have a valuable potential role in locations where grid connections are too expensive, notably in remote and sparsely populated areas, especially for functions such as pumping water where intermittency is not a problem.”

Simpson also makes a key point regarding the reduction of carbon emissions: “Because of the cost of providing additional stand-by generating capacity, it is unlikely that wind power will ever account for more than 20% of electricity generation through the National Grid. That being the case, its development can make no substantial contribution to a reduction in carbon emissions from power generation.” 7

On the other hand, market-based energy production and conservation advocates reject the socialistic/fascist idea that the energy economy is rife with “market failures”; and reject the statist assumption that politicians and regulators—no matter how honest, intelligent or well-intentioned—can improve on millions of private choices by individuals in a free market. By relying on undistorted price data and the legitimate role of governmental protection of contracts and private property rights, market-based energy solutions are the best way to ensure the efficient use of economic and environmental resources, and provide inexpensive, reliable electrical service to Americans.

Capital Costs

The true costs for a particular wind power project (wind farm), including generation and delivery of power, are many and are difficult to determine with certainty due to a multitude of variables.

Generally, the data supplied by the DOE’s Office of Energy Efficiency and Renewable Energy and the National Renewable Energy Laboratory (NREL), and the various wind energy trade associations and lobbyists are highly misleading, inaccurate and/or overly optimistic. Listed below are some of the most important capital cost factors.

1. Turbines, blades, and related mechanisms mounted at the top of the towers. There are a wide variety of turbines available and under development, and at least 10 major turbine manufacturers, most of them foreign (Vestas, NEG Micron, Mitsubishi). GE manufactures some turbines in the US and some in Europe. As with any product, prices vary with demand, quantity, and currency exchange rates, and are affected by various government R&D subsidy programs.

2. Towers of various styles and heights, some manufactured in the US while others are imported.

3. The base and pad area, usually about 50’x50’, contain tons of steel-reinforced concrete and gravel. The amount is determined by local soil conditions, tower height, turbine size, wind conditions, terrain, etc. Each tower (a site usually means 15-20 towers to make investment feasible) requires a hole filled with tons of steel-reinforced concrete. It may be as much as 30 feet deep or more and contain more than 100,000 cubic feet of concrete, production of which is a major source of CO2 and other pollutants.

A distinct air-emission problem of wind capacity is created when a new project is built, especially where there is surplus electricity-generating capacity. Because wind farms require hundreds of tons of energy-intensive materials, virtually all of the air emissions associated with the gas or electricity used to make the materials (such as cement or steel) must be counted against the “saved” air emissions once the farm comes on line and displaces fossil-fuel-generated output. For a wind farm of 45 effective MW, for example, the emissions associated with 10 million pounds of materials must be calculated. Scientific and economic analysis of ‘embedded’ emissions is another indication the “green” balance sheet for wind is not as rosy as claimed.

4. Access roads and clearing of land. Costs are affected by terrain and other local conditions. In some cases where siting is in wooded areas, trees may be cleared to eliminate interference with wind flow.

On mountain ridges and many other locations, it may be necessary to blast into the bedrock. Construction at a site on the Slieve Aughty range in Ireland in October 2003 caused a 2.5-mile-long bog slide due to road construction where the peat bog was stripped down to bedrock. Just as costs for restoration of land for coal strip-mining are passed on to consumers and taxpayers, costs for restoration of land at “wind farm” sites must be allocated.

FPL Energy stated, “although construction is temporary [a few months], it will require heavy equipment, including bulldozers, graders, trenching machines, concrete trucks, flatbed trucks and large cranes.” Transporting all the equipment, tower sections and rotor blades into an undeveloped area requires the construction of wide straight roads.

5. Computer equipment, cabling and controls which vary from one project to another.

6. Interconnection costs, substations, local transmission lines etc. permitting connection from a “wind farm” to power company transmission lines and the grid. Transmission line costs vary widely by region and specific project due to distance, present capacity, terrain and availability of rights-of-way.

Although electricity produced by wind turbines use transmission capacity inefficiently, the lines must be designed to carry full output. Since acceptable sites for “wind farms” may be distant from the electricity destination, both transmission costs and line losses may be high. Very often, upgrades to existing major transmission lines are needed.

7. Cost of development (which can be capitalized if the project becomes operational but must be written off immediately if the project isn’t built) includes the cost of gaining land use and zoning approval, and regulatory permitting from local/state/federal authorities regulating such projects. Costs vary widely and can include significant fees for lawyers, public affairs/lobbyists, and engineers involved in the effort to gain approval. Legal challenges may also add significantly to development costs.

In addition, developers are generally liable for damage to existing infrastructure (roads) caused by wind farm construction. Some states offer up-front subsidies to defray some or all of these costs but the money used to provide these subsidies is often collected from electric customers via charges added to monthly electric bills, so-called “public benefit charges.”

8. Cost of financing: These costs depend on such factors the owner’s credit rating, the proposed debt-equity ratio, the market for the electricity that would be produced, whether a contract is in place for its sale, and the terms of the contract. Output uncertainty also increases financing costs of outside lenders compared with more predictable, proven power generation. Therefore, a premium has to be added to the interruptible wind rate to compare it with firm generation alternatives such as gas-fired combined-cycle plants.

9. Payments in lieu of taxes: Sharp reductions or exemptions from local government property taxes which are provided in several states, creating a situation where “wind farm” owners can appear magnanimous by making “voluntary” payments to counties, towns and schools to help cover costs. Such payments tend to be much less than the taxes that have been forgiven. Since Virginia has virtually no experience with wind energy, the legislative and state regulatory effects on local property taxation have yet to be determined.

10. Land: if owned and capitalized or, if leased, lease rates and terms.

“The job of any wind turbine is to extract energy from the wind, thereby slowing the movement of air. Therefore the wind turbines must be widely spaced so that they are never in the lee of each other. I quote from an article on the EPA website. ‘Contemporary wind projects are typically rated at 25 to 100 MW. A 25 MW project might have 60 to 70 turbines covering 1500 acres.’ One MW is a megawatt, one thousand kilowatts, the average per-capita electrical power usage of about 900 US citizens.

“Let’s translate those numbers. Twenty-five megawatts divided by 1500 acres is 16.7 kilowatts per acre, but that’s using the nameplate value, which is about five times higher than the average value. This translates into an average of about 3.3 kilowatts per acre. Assuming ideal conditions, to produce as much energy in a year as a single 1000-MW electrical power plant would require about 13,000 wind turbines on about 470 square miles of land area. That’s about the area that would be bordered by Route 470 on the west, south, and east, and by 88th Street on the north. Picture that amount of land covered with huge windmills that produce unreliable electricity. And even ideally, they would produce not even half of the electricity used in the Denver metropolitan area.” 8

Wind farms fail the land-use test compared with fossil-fuel alternatives. A wind farm requires as much as 85 times more space than a conventional gas-fired power plant. Estimates range between 10 and 80 acres per megawatt—from 30 to more than 200 times more space than needed for gas plants. Wide spacing (a 50 MW farm can require anywhere between 2 and 25 square miles) is necessary to avoid wake effects between towers. The world’s 5,000 MW (nameplate) wind-power capacity in 1995 consisted of 25,000 turbines—little bang for the land usage buck.

A single 555-megawatt gas-fired power plant in California generates more electricity in a year than do all 13,000 of the state’s wind turbines. The gas-fired plant sits atop a mere 15 acres. The 300-foot-tall windmills impact over a hundred thousand acres to provide expensive, intermittent, insufficient energy.

11. Decommissioning costs

Some experts urge landowners/local governments ensure decommissioning costs are covered by cash bonds held by independent third parties. Because many wind farm “owners” are LLCs with few assets and because tax breaks for wind are heavily ‘front-loaded’ (depreciation, 5-6 years; production tax credit, 10 years), there are huge incentives for the sale of facilities after tax breaks are used, or for abandonment if costs of maintenance, repair and/or replacement rise substantially. There is little protection for landowners/localities from surety bonds that depend on premium payments or cash bonds held by an LLC-owner in case of insolvency or abandonment.

The ancillary environmental costs are not minor, even to wind power’s leading proponents. Paul Gipe, in an October 15, 1996, letter to the chairman of the CEC, called for a moratorium on new wind subsidies until the problems of previous construction were addressed:

“I am a longtime advocate of wind energy in California and my record in support of the industry is well known. I have chronicled the growth of California’s wind industry for more than twelve years. It therefore pains me greatly to urge the Commission to…recommend to the legislature that no funds from the [California Competition Transition Charge] be distributed to existing or future wind projects in the state. Funds that were destined for this purpose should instead be deposited in a wind energy cleanup fund to be administered by the Commission. Money from this fund could then be used to control erosion from plants in California, to remove abandoned and non-operating wind turbines littering our scenic hillsides, and to mitigate other environmental impacts from the state’s wind industry.” As Gipe has reminded his audience elsewhere, “The people who build wind farms are not environmentalists.”

Operations, Repair and Maintenance, and Replacement Costs

There are many variables and some big unknowns. Note that “wind farms” require and consume electricity from the grid to operate control equipment, even when not generating power.

1. Actual operating experience is probably around 5 years for the smaller (660 kW–750 kW) turbines, 3 years for the 1.5 MW units, and a few months for the really big ones like GE’s new 3.6 MW turbine. Anyone claiming to have solid numbers may not be telling the truth. Some manufacturers have had costly problems with gearboxes on big, relatively new machines.

2. Useful life of the turbines.

3. Land rents can be expensed. Most land seems to be leased with prices varying from around $1,500 per MW of capacity to alleged offers as high as $15,000 per MW. Some leases are fixed payments and some vary with amount of electricity produced.

4. Insurance.

5. Property, sales, use and other taxes: Due to a variety of “incentives”, the tax burden on “wind farm” owners is very low.

6. Monitoring and Response Costs may include monitoring and responding to noise and environmental complaints, fire from lightning, icing and other dangerous conditions. Some municipalities may require establishment and maintenance of a “Complaint Hotline” and/or periodic reporting to ensure compliance with terms of conditional use permits.

Cost per kWh

DOE, National Renewable Energy Lab (NREL) and the wind industry often cite cost per kWh numbers but seldom, if ever, provide full, accurate data underlying their estimates. Actual cost per kWh may vary widely depending on items identified above, but two factors have an especially large impact on actual average cost per kWh of electricity from wind:

1. Capacity factors: Actual costs per kWh depend on the number of kWh of electricity actually produced. Wind speed is one critical factor in determining the amount of electricity produced and wind speed varies widely with stronger wind tending to occur at night and in colder months. Wind speed measurements taken during winter months are atypical. Wind characteristics also vary by height of the measurement and terrain. Actual capacity factors and actual kWh production tend to be less than claimed by “wind farm” developers. Inflated figures may be used to assure support of projects by lenders and government agencies. Published estimates of “wind resources” and “wind classes” in various areas may be based on limited empirical data.

2. Useful life of turbines: Estimates of cost per kWh also depend heavily on assumptions about the useful life of turbines, a big unknown because of limited experience with machines now being used. The numbers will be much different if an assumed life is 20-years or 30 years—total estimated costs divided by kWh produced over 20 years vs. 30 years.

Published estimates of lower per kWh costs of electricity from wind are often based on vague assumptions about wind conditions, site availability, bigger machines, higher efficiency, “economies of scale” or other estimates that may or may not prove to be correct.

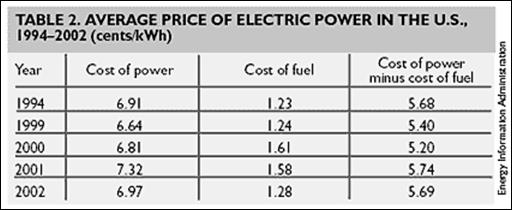

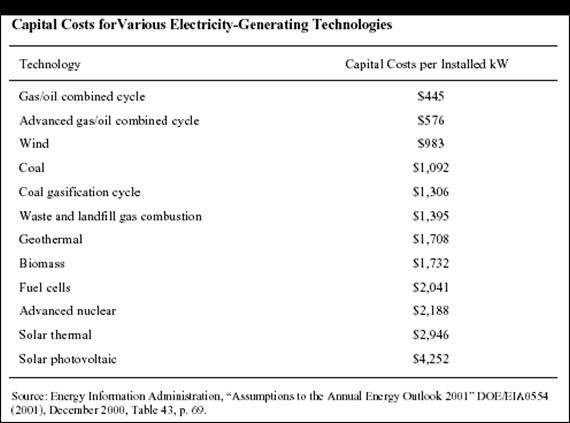

It is erroneous to conclude that even if wind is not competitive now, it soon will be. Wind is competing against improving technologies and the increasing abundance of natural resources. The cost of gas-fired combined-cycle plants, the most economical electricity-generation capacity for central-station power at present, has fallen in the last decade because of improving technology and a 50 percent drop in delivered gas prices adjusted for inflation. The energy-efficiency factors of gas turbines have increased from just above 40 percent in the early 1980s to nearly 60 percent today (1998). Forecasts by the DOE and other sources expect continued efficiency improvements in the years 2000 through 2015 for gas-fired generation. One forecast is that new gas-fired generation of virtually any capacity will cost from $200 to $450 per kW, generating power at 2 cents per kWh.

Gas-fired generators, unlike wind generators, are able to “lock in” the price of gas (energy) supplies with long-term contracts and through futures markets to remove price risk and ensure a price saving over ‘renewable-energy’ projects with relatively high capital costs.

Costs of intermittence, variability, and backup generation

Costs may vary widely depending on the control area, the location of the “wind farm,” location and type of backup generation units, the output and variability of output from the “wind farm,” the share of capacity on line from the wind turbines, the amount of load on the grid at the time, and the capacity of the transmission lines—all related to the fact wind turbines produce electricity only when wind is blowing within the designed speed ranges.

For example, the forty-four 1.5 MW turbines employed at FPL Energy’s Mountaineer Energy Center, Backbone Mountain, WV, according to the turbine manufacturer NEG Micon, begin producing electricity when the wind reaches about 8.9 miles per hour, achieve rated capacity at about 33.6 mph and cut out at 55.9 mph.

The amount of power produced is not determined by consumer demand, but instead by the available wind. That is, a switch can not be activated to increase wind speed or to make it blow in a steady stream. If you want power, you wait for the wind.

It is important to understand the AC (alternating current) grid system does not have ‘storage’ capacity. Unlike a small, local DC (direct current) system with storage battery backup, the AC grid supply/demand must be kept in balance. Since the grid or control area must be kept in balance at all times (supply and demand, frequency, voltage), generating units must be immediately available at all times to provide backup service (or balance) for the electricity (if any) coming from wind turbines. The units providing the backup service may be operating in an automatic generation control mode, running at less than peak capacity, and/or running in spinning reserve mode.

Depending on wind conditions, the amount of backup capacity may have to equal the peak capacity of a “wind farm.” That is, if wind conditions exceed the cutout speeds, the entire output of the “wind farm” could be lost. Uncertainty and variability of generated power from “wind farms” result in costs. Those costs are properly allocated to the cost of the electricity from wind turbines.

Some limited empirical work has been done to define these costs but it is quite limited in terms of the period of time covered and the location(s) studied. There is no universally applicable, empirically based cost estimate available. These “costs” may, at some point, be established in wholesale ancillary service markets. PJM*, for example, apparently has created or is experimenting with such a market for spinning reserve capacity.

Almost certainly, a control area having significant hydro capacity in reasonably close proximity to a “wind farm” would have relatively low backup generation costs because of the excellent load-following characteristics of hydro generation. That is, assuming that variation in the flow of water through the hydro plants can be accommodated within constraints on the hydropower facility such as levels of water in the reservoir and in the river downstream of the plant. However, actual backup power costs are likely to be higher when generation is powered by other energy sources.

“Colorado has two wind farms built by Xcel Energy under orders of the Colorado Public Utilities Commission (PUC), the utility regulatory agency in Colorado. The first wind farm was built near Ponnequin at the Wyoming border and the other is located near Peetz on Colorado’s Nebraska border.

“All Xcel customers receive a portion of their electricity from wind farms, but some customers can choose to receive their electricity “exclusively” from wind power by joining Windsource, a “wind-only” option offered by the company which provides electricity to 95% of Coloradoans. Windsource customers elect to pay an average $15 more a month ($2.50 per “block” of wind power) to get “all” their power from wind on the assumption that the program will help the environment by reducing usage of natural gas and coal.

“If you believe the PR being offered by Xcel’s Windsource department and the greenies at the PUC, you would think that by joining the Windsource program you would get all your power from wind, that more wind farms will decrease the number of natural gas plants, that you would be helping the environment and saving money. These are all myths created by the pro-wind lobby.

*PJM ensures the reliability of the largest centrally dispatched control area in North America by coordinating the movement of electricity in all or parts of Delaware, Illinois, Maryland, New Jersey, Ohio, Pennsylvania, Virginia, West Virginia and the District of Columbia.

“The biggest misunderstanding is to think that by joining Windsource you will only get wind-generated power. If the wind blows less than seven miles an hour or more than 56 miles an hour, the windmills are locked down by Xcel’s computers so that they cannot spin. Even when the wind blows between seven and 56 miles an hour, the windmills are sometimes locked down because the PUC and Xcel both want a steady flow of wind-generated electricity, not too little or too much for the windmill conductors or the power grid. Wind power is about 30% efficient in producing electricity, compared to other sources. Yet, Windsource customers demand power 100% of the time, not a measly 30% of the time. Where does their power come from the other 70% of the time? It comes from back-up power plants, which are either natural gas or coal plants; Windsource is not a wind-only program. In addition, natural gas is often used to run the machines that convert wind into power.

“It is only from erroneous logic then that one can conclude that the expansion of wind farms will reduce natural gas and coal plants in Colorado. Wind is simply not efficient enough at producing power to be relied upon without its safety nets of natural gas and coal.

“Wind farms cost about $384,000 more per megawatt of power than coal plants—or about one-third more. Under the public utility law, Xcel can pass these costs on to all customers in Colorado, all of whom receive wind power. Remember that is not just the Windsource customers who receive power from wind, as every Xcel customer in Colorado receives at least a minimal amount of wind power—all customers of Xcel must pay for wind-generated electricity. Xcel and the PUC cannot calculate exactly how much each customer pays, but they admit that the PUC ordering Xcel to build the wind farms has raised the price of electricity for every single customer.

“Customers wishing to join Windsource voluntarily agree to pay about $15 more a month for their electricity—but why should the PUC force everyone else to pay for such an inefficient and environmentally unfriendly energy source?” 11

Transmission and integration costs

Electricity from wind turbines generally makes inefficient use of the transmission capacity. Enough transmission capacity must always be available to handle the peak output of a “wind farm.” However, that peak output is unlikely to occur more than about 30% of the time. The capacity may not be used at all by the electricity from wind turbines for 50 to 70% of the time.

Transmission costs also tend to be high because acceptable sites for “wind farms” are often distant from load centers, which mean both higher capital costs due to longer lines and greater line losses of electricity. In some cases, heavy concentration of wind turbines has made it necessary to add (upgrade) transmission capacity to serve the output from “wind farms” (Texas, Minnesota, Nordel Grid in Europe).

1. Extra grid management burden. The variable output from “wind farms” imposes extra costs for the management and control of the grid or control area. These costs may be minor if the electrical output from the “wind farms” is small and/or it can be handled with automatic generation control. The owners or managers of some control areas have adopted somewhat arbitrary cost factors to compensate for the management costs (e.g., Bonneville Power). Several studies are underway to get a better fix on the true costs but they are complicated by the wide variability in those costs.

2. Penalties in competitive markets. Some grid owners or managers have applied penalties to electric generator owners or operators who deliver more or less electricity to a transmission system than was bid into the system. Often these penalties are designed to (a) encourage generating companies to help keep the grid in balance by delivering amounts of electricity promised, when promised, (b) pay for costs imposed when electricity delivered differs from contracted amounts, and (c) discourage “gaming.” The wind industry has complained such penalties are inappropriate for wind because of its inherent intermittence, variability and unpredictability. Bonneville, under pressure from the industry and DOE wind advocates, recently reduced its imbalance penalty.

3. Who bears the real costs? In some cases, all or a portion of the costs of (a), (b) and/or (c) above have been imposed on the “wind farm” owner. In other cases, it appears the purchaser of the output from a “wind farm” pays a specified amount for each kWh of electricity and absorbs the extra costs. Unless the costs are clearly assigned to and paid by the “wind farm” owner, it is likely they are rolled through and spread over all of an electric suppliers customers, probably without the knowledge of those customers.

4. Shifting of costs from “wind farm” owners to electric customers by regulation. FERC apparently has approved an approach developed in California—and favored by the wind industry—which limits penalties associated with the impact of electric power from “wind farms” on transmission. Also, the Minnesota PUC recently approved a $148 million expansion of Xcel’s transmission capacity in Southwestern Minnesota that Xcel claimed was necessary to serve planned new “wind farms.” Those costs apparently will be included in rate base and spread over all Xcel’s Minnesota customers rather than being allocated to the owners of the planned “wind farms” that make the expenditures necessary. Also, the American Wind Industry Association (AWEA), the industry’s Washington based lobbyists, have a major effort underway to shift the costs of transmission of electricity from wind turbines away from “wind farm” owners.

In a recent study of integration costs, Hirst and Hild state:

“In spite of the limitations listed above, we believe the present results are valuable and roughly representative of what would occur with a more comprehensive analysis. These results show clearly that modest amounts of wind receive payments (net of charges for regulation and intrahour balancing) almost equal to system lambda. The integration costs are low because the correlations between wind output and system load, as well as their forecast errors, are very low. However, as the amount of wind capacity installed in an area increases, the payment drops. Although adding wind farms throughout a region increases the diversity of the wind output and improves the accuracy of the DA wind forecasts, the payments decline. This drop occurs because each increment of wind energy pushes the existing conventional generation to lower levels on the supply curve, with lower marginal costs. Also, the more wind that is added to a system, the more the conventional generation must move up and down, both intra- and interhour, to adjust for the lack of control, unpredictability, and variability of wind output.” 12

(emphasis added)

Income taxes, tax breaks and subsidies for “wind farm” owners

Some of the above-listed costs of electricity from wind are dwarfed by the amounts of tax breaks and subsidies available to “wind farm” owners.

Perhaps the most striking example is California, once home to 90 percent of the world’s wind power—1,700 MW have been online since the mid-'80s—California’s share has slipped to just 10 percent over the last decade.

Approximately $1 billion was diverted from federal and state taxes into wind farms between 1981 and 1985 to jump-start the world’s wind power industry in California. Both federal and state investment tax credits were terminated in 1986 due to publicity surrounding the abuse of this investment tax shelter. Congressman Pete Stark of Hayward led the fight to terminate the investment tax credits by proclaiming, “these aren’t wind farms, they’re tax farms.” 21

1. Tax breaks. Tax breaks for “wind farm” owners don’t show up directly in electric bills but, nevertheless, are part of the full, true cost of electricity from “wind farms.” Tax breaks shift costs from the “wind farm” owners to remaining taxpayers. Important tax breaks include:

a) The Federal Production Tax Credit is currently $0.018/ kWh. The rate is adjusted for inflation, available for the first 10 years of operation of the wind facility and is described in a “White Paper” on AWEA’s web site, http://www.awea.org/policy/documents/Transmissionwhitepaper12-2002.pdf

b) Five-year double declining balance accelerated depreciation (5-yr., 200% DB) is a generous form of MACRS (Modified Accelerated Cost Recovery System) now available in federal tax statutes to “wind farm” owners. This permits a wind farm owner to recover the full amount of capital investment in 5 to 6 years through depreciation deductions from income compared with 20-year, 150% DB accelerated depreciation for most other generating units. Simple cycle gas turbines qualify for 15-year, 150% DB.

The depreciation deductions for commercial wind energy facilities are:

- Under “Normal” 5-yr. 200% DB: 20%, 32% 19.2%, 11.52%, 11.52%, 5.76%

- Under “Bonus”: 5-yr. 200% DB established by the Job Creation and Worker Assistance Act of 2002 which applies to qualifying assets purchased after September 10, 2001 and before September 11, 2004, provided those assets are placed in service by January 1, 2005): 44%, 22.4%, 13.44%, 8.064%, 8.064%, 4.032% (Note: increased under the latest tax bill to 60%, 16%, 9.6%, 5.76%, 5.76%, 2.88% through the end of 2004, thus tax liability calculated below would be reduced further)

Accelerated depreciation produces huge tax avoidance benefits in the first few years of project ownership. The value of this accelerated depreciation is higher under “bonus” schedule described above. However, those are scheduled to end by January 1, 2005, so the value of accelerated depreciation is illustrated here using the “Normal” deduction schedule described, which is still exceedingly generous to “wind farm” owners:

Assuming a 100 MW (100,000 kW) “wind farm” with a capital cost of $1 million per MW, or a total capital cost of $100,000,000 million, coming on line after the “Bonus” provisions have expired, the owner can deduct $20,000,000 in depreciation from income for the 2005 tax year. (The depreciation deduction in the first year (20%) is less than the second year (32%) because the IRS prescribes the “half-year convention” which permits deducting one half-year’s depreciation in the first tax year regardless of when the facility actually begins operation during that year. (See IRS Publication 946.)

With a 35% marginal tax rate, the “wind farm” owner could reduce federal income tax liability by $7,000,000 before taking advantage of the federal Production Tax Credit.

If the “wind farm” began operation on July 1, 2005, and produced at an annual average 30% capacity factor for the rest of the year, it would produce 132,480,000 kWh (100,000 kW x 4416 hours x .30 capacity factor). Therefore, the value of the depreciation deduction in 2005 in reduced federal tax liability would be equal to $0.0528 per kWh ($7,000,000 divided by 132,480,000 kWh). When the $0.018 per kWh production tax credit is added, the value of the two federal tax benefits in 2005 would add up to $0.0708 per kWh.

In the second year, 2006, the owner would be able to deduct $32,000,000 from income. With a 35% marginal tax rate, the “wind farm” owner could reduce federal income tax liability by $11,200,000 before taking advantage of the federal Production Tax Credit. If the “wind farm” averaged a 30% capacity factor 9 for all of 2006, it would produce 262,800,000 kWh. The value of the reduction would equal $0.0426 per kWh in 2006, not counting the $0.018 per kWh PTC. When the $0.018 per kWh production tax credit is added, the value of the two federal tax benefits in 2003 would add up to $0.0606 per kWh.

c) Reduction in state corporate income tax due to federal accelerated depreciation. In most states, accelerated depreciation can also be used to reduce state corporate income tax liability.

For example, in a state that fully conforms its corporate income tax to the federal system and has a 10% corporate tax rate, the “wind farm” owner could reduce state income tax liability by $2,000,000 in 2005, or the equivalent of an additional $0.015 per kWh for a “wind farm” that began operation on July 1, 2005, with a 30% capacity factor.

In 2006, the “wind farm” owner could reduce tax liability by $3,200,000 or the equivalent of an additional $0.012 per kWh.

d) Reduction in state and local property, sales and other taxes. Several states have also reduced or eliminated other taxes and, therefore, shifted more costs from “wind farm” owners to remaining taxpayers:

- Iowa exempts materials used in constructing wind farms from sales and use taxes and has sharply reduced property taxes (eliminating them totally in the first year, then raising them in 5% increments until reaching 30% of normal property taxes.

- West Virginia has reduced both Business & Occupation Taxes and Property taxes for “wind farms” by about 90%.

- Wisconsin, Minnesota and Kansas exempt wind facilities (the value added, not the land) from property taxes.

- North Dakota exempts large wind project equipment from sales tax and provides a 70% reduction in property taxes.

“In 1983, the Montana legislature acted as though the state was rich and would always wallow in money. Believing federal subsidies weren’t enough, they began offering state tax credits equal to 35 percent of the costs of purchasing, installing, or upgrading wind energy generating equipment and infrastructure. Despite declining revenues, the Montana legislature expanded this in 2001 to cover all “alternative” energy sources. Although Montana is ranked fifth in the contiguous US for potential wind energy (at 116,000 megawatts), there is only one existing wind farm. It produces a mere 0.1 megawatt vs. 128 megawatts for the average fossil fuel-powered plant in Montana. As usual, subsidies have failed.” 13

Additional subsidies for the wind industry

On March 29, 2004, U.S. Deputy Secretary of Energy Kyle McSlarrow announced the Department of Energy will open negotiations for 21 public-private partnerships to greatly expand potential U.S. wind development through advances in cost effective low wind speed technology. The value of the cost-shared projects is expected to total $60 million over the next four years. The announcement came at the wind industry’s Global WINDPOWER 2004 Conference in Chicago. The 21 new partnerships announced today were selected under the second phase of this project, and the selected companies will plan to share 50 percent of the project costs overall.

“The nation’s vast wind energy resources can play a much larger role in our energy supply portfolio,” Deputy Secretary McSlarrow said. “These industry and university partnerships will help develop next generation wind technology and open the door to wind power at many locations around the country that otherwise would not be cost-competitive.”

Much of the commercial wind power development has occurred to date at high wind sites, in other words the “best” wind sites. However, many of these sites are located in remote areas that do not have ready access to transmission lines. Moreover, easily accessible prime high wind sites are becoming limited. President Bush’s National Energy Plan specifically cited low wind speed technology as an opportunity to significantly expand use of wind energy. The new low wind speed projects will focus on technology improvements for making more widespread low wind speed sites cost competitive with high wind sites. Efforts include new R&D projects targeting multi-megawatt scale components and turbine systems for land, as well as offshore applications. 14

1. Federal subsidies, all of which shift costs from the wind industry to taxpayers, include:

- $38 million per year for US Department of Energy “wind energy R&D”

- Promotional “studies,” “analyses,” “reports,” web sites, and conferences paid with tax dollars flowing through DOE’s Office of Energy Efficiency and Renewable Energy, and carried out by DOE employees and employees of DOE National Labs and other contractors, grantees and subcontractors.

- Renewable Energy Production Incentive (REPI) which provides direct per kWh payments to organizations that do not pay income taxes (rural electric coops, municipal utilities), at the same per kWh rate as the Production Tax Credit.

2. State subsidies. Some of these may be paid from general tax revenues but many are paid from so-called “public benefit charges” added to electric customers’ monthly bills, which charges raise well over $1 billion per year. Examples of such subsidies include but are not limited to:

- New York and Illinois- Grants to “wind farm” developers (In NY, $22 million have been announced).

- California– Payments to customers who agree to buy electricity produced from “renewable” energy sources (this program may be suspended at present).

- Minnesota– State production tax credits.

- New Mexico– Use of industrial development bonds.

States may also impose ‘fuel diversity premiums’ to penalize reliance on natural gas for power generation. These premiums affect costs of backup generation when “wind farms” are not delivering power and are passed on to all ratepayers in the area.

3. Renewable portfolio standards and “Green” energy programs. Renewable portfolio standards (RPS) adopted by several states are another form of subsidy for “wind farm” owners. RPS are particularly insidious since they impose higher costs on millions of electric customers without their knowledge. The standards force suppliers of electricity to purchase electricity from “wind farms” or other “renewable” energy facilities, generally without regard to its higher cost. In some cases, the few electric customers who agree voluntarily to pay a premium price through so-called “green” energy programs for electricity produced from “renewable” sources pay part of the extra cost. Typically, only a very small percentage of customers volunteer to pay premium prices. The remaining cost of the electricity as well as the cost of administering the ‘voluntary’ program is passed on to electric customers in their monthly electric bills.

The Intermountain Rural Electric Association wants its 118,000 members near Denver, Colorado to oppose state legislation that would require some utilities to source 10% of their power from renewables, even though the proposed law would not apply directly to it. “Consumers should understand that mandating the use of this expensive, fluctuating energy source will not only increase electric

rates, it will wreak havoc on the reliability of the electric grid,” the co-op says in a letter sent with invoices. “While wind advocates claim that wind is competitive with conventional generation, they fail to reveal its true costs.”

The initial cost of windfarms is “much higher” than other generation plants and the $4,000 per kilowatt capacity is three times higher than a coal-fired

facility. Tax incentives cover one-third of the construction costs of new turbines, but the expiration of production tax credits would force consumers to pay an additional 4.3¢/kWh. Windfarms are only 25%-30% efficient and fail to generate any power on calm or very windy days, and “proponents neglect to mention that for each windfarm, an equivalent amount of conventional generation must be built

to provide backup power when there is too much/little wind,” it says. Rights-of-way must be purchased and additional transmission lines constructed to remote windfarms, but “these ‘hidden’ costs and taxes are never included in proponents’ kWh cost calculation.” “If wind energy truly made good economic sense, we wouldn’t need a law to force utilities to produce it.”15

Nevada Power Co. and Sierra Pacific Power Co. said on April 9, 2004, delays and terminated alternative energy projects are preventing them from meeting the requirements of Nevada’s renewable-energy law. The utilities, both subsidiaries of Reno-based Sierra Pacific Resources, contracted with independent power companies to build renewable energy facilities rather than build their own. But the two utilities have faced a series of “supplier delays, defaults and terminations” for renewable power.

Because of those delays and postponements, Nevada Power and Sierra Pacific will not meet the state’s minimum requirements for renewable energy for 2003 and 2004. The renewable-energy law requires them to obtain increasing portions of their power supply from renewable resources, mandating the two electric companies obtain 5 percent of the power they sell from renewable or green power sources last year, increasing to 15 percent by 2013.

In their report, the utilities said many of the projects they were counting on to meet the requirements have been canceled. The Desert Queen wind project, which was being developed at Goodsprings by Cielo Wind of Austin, Texas, depended on extensions of federal tax credits. “When those extensions weren’t granted, that project failed,” the utilities reported. Also, the MNS Wind project that was to be built at the Nevada Test Site was scheduled to start operation by the end of 2003, but the U.S. Air Force objected and the project was scuttled. The Ely Wind project near the city of the same name has been delayed two years. The two utilities reported that other projects have been delayed. Ely Wind and Solargenix “experienced difficulty finalizing their financing arrangements,” the utilities said. 16

Rising costs due to finite resources

Because “wind farms” have been, and are being, sited at optimal wind locations, and because there are a finite number of sites which are suitable for generating power at costs even approaching modern gas-fired generation, the wind power industry has been scrambling to design and produce more efficient and less expensive turbines in order to take advantage of less than optimal wind conditions.

Production costs involve the limited nature of ideal sites for “wind farms”. The Energy Information Administration (EIA), a DOE sub-agency, considers wind a finite resource because the ideal weather and land conditions to satisfy the demands of this energy type are limited.

Because of the finite nature of real estate available for wind power, production cost will almost certainly tend to increase, instead of falling, even assuming design and technical advances in the efficiency of turbines.

To date, overcoming the technical difficulties has been costly, especially for taxpayers, and results have often been elusive. The following example is illustrative.

For the past 13 years, the Wind Turbine Co. from Bellevue, Washington has been experimenting with a two-blade, down-wind turbine (as opposed to the usual three-bladed, wind-facing turbine) that would use fewer materials to build and cost less to manufacture. They claim to be on the brink of a technological breakthrough that could lower the cost of wind energy production by 25 percent.

The company believes it has perfected a turbine design that has eluded engineers for years. In the next few months, it hopes to either raise a round of venture capital that will fund it through commercial development of its turbine. If it fails, the Wind Turbine Co. will blow away.

The Wind Turbine design would use two blades that are turned away from the direction of the wind, allowing the blades to flex away from the tower, similar to the way helicopter blades bend.

Typically, a 1 MW turbine costs about $1 million to develop. Wind Turbine says its design could trim as much as 25 percent off the cost of developing a 1-megawatt wind turbine and may bring the cost of wind energy on par with other forms of power, without using the federal wind energy production tax credit.

While the company believes it has mastered the technical difficulties in the down-wind turbine, it still needs to convince investors that wind technology will pay off. And in the past that hasn’t been easy sell. So far, Wind Turbine has existed on a total of $14 million in research contracts from the federal Department of Energy and the state of California.

It has also received a $500,000 investment from Dow Chemical Co. and a Swedish angel investor, and this summer hopes to close a venture financing deal between $5 million and $10 million. The company is in discussion with a Midwestern utility interested in taking an equity stake in the company. Wind Turbine has exhausted its sources of government funding and needs a capital infusion to continue.

The down-wind turbine design sounds like a remarkably simple concept, but over the past 20 years several companies have tried and failed to engineer it.

“There are a lot of interactions between aerodynamics and structural dynamics that had to be figured out,” said David Simms, division manager at the National Wind Technology Center, a division of the National Renewable Energy Laboratory in Golden, Colo. “Because of the turbulence in the atmosphere that the turbine operates in, it’s pretty difficult to ensure they are always going to behave properly, no matter what the flow conditions are.”

The company had a serious setback two years ago when its control system malfunctioned, sending a blade crashing back into the tower at its California prototype, located in Antelope Valley north of Los Angeles. The mishap put the project’s development one year behind schedule. If the company is able to secure a round of financing and bring its design to market, it still must convince the industry to change its design. 17

It will be interesting to follow the development of Wind Turbine’s and other taxpayer-subsidized “design breakthroughs” in light of the 1976 study by the DOE which estimated that wind power could supply close to one-fifth of all U.S. electricity by 1995—a fact trumpeted by the American Wind Energy Association in congressional hearings in 1984. In 1996, instead of 20 percent, wind had a 1/10 of 1 percent share of the U.S. electricity market—an overestimate of 20,000 percent.

Paul Gipe stated, “Whenever renewables seem stymied, environmentalists, regulators, and politicians respond that more R&D is needed. This cry arises from an outmoded belief that technological and social innovations spring from the womb of large centralized organizations. This model of innovation no longer produces results either in government or commerce. The call for more R&D diverts attention from what is needed most, structural change in the market.”

Availability factors, capacity factors and “homes served”

Wind energy advocates often mislead the public, media and government officials with claims about “availability” and “homes served.”

Large-scale wind power is neither pollution-free nor, given current technology, cost-effective. Because the wind doesn’t blow constantly, some other generating facility must be ready to provide energy when the windmills don’t. “Dirty fossil fuel”-fired plants usually accomplish this. (Nuclear power is looking more attractive. It already provides 70 percent of Vermont’s electricity.)

The DOE admits, “While the cost of wind power is decreasing, it is still more expensive to produce relative to electricity from existing, large coal, natural gas, and hydroelectric power plants.” Most new wind projects are developed “because of the availability of federal tax credits and incentive payments to municipal utilities for wind energy.”

1. Availability factors are meaningful for generating units that are “dispatchable” (can be called upon to produce electricity whenever needed) but are meaningless for “intermittent” generating sources such as windmills which can produce electricity only when the wind is blowing within certain speed ranges.

Electricity from wind turbines is of less value than electricity from “dispatchable” generating units because it is available only when the wind is blowing within certain speed ranges. In electric industry terms, it has very little, if any, “capacity” value. It provides “capacity” value only if the wind happens to be blowing when electric demand is at high levels (at or near peak). Winds are not uniform throughout a day or year. Instead, winds tend to be strongest at night and in cold months while many electric systems in the US experience highest demands during summer afternoons.

The wind industry often cites “availability factors” which the industry seems to define as time when the wind generation equipment could be generating if wind were available within the design speed ranges. Such use of “availability” is totally misleading and deceptive.

2. Capacity factors for wind turbines and “wind farms” are more meaningful since they measure kilowatt-hours (kWh) actually produced by the wind turbines. Capacity factors are determined by dividing kWh produced by the rated (“nameplate”) capacity of the turbine(s) times the hours in the period for which the factor is calculated–usually a year or a month.

Capacity factors are not totally meaningful because the electricity may be generated at a time when it isn’t really needed or when electricity is available at less cost from other generating sources.

Wind has its uses, but providing steady power is not one of them. If the wind speed drops from 10 miles per hour to 9 miles per hour — a mere 10% drop — the power available from a wind turbine drops almost 30%. If the wind speed doubles from 10 mph to 20 mph, suddenly there is eight times as much power available. These rules are due to the air itself, and have nothing whatsoever to do with windmill design. Wind turbines produce the lowest-quality electricity on the planet.